Harrison – Harrison Councilor Gerry Palmer posted his overview of the last Council Meeting for 2020 (December 20).

From Facebook and Harrison Hot Springs Bulletin Board:

My summary of last nights meeting. Sorry for the length. I reiterate that I do not speak for the Village or for Council. I am providing only my own view as a councillor. A councillor who was foolish enough to walk to the meeting last night in the cold. That sure reminded me of growing up in Northern Ontario.

The Council Procedure Bylaw amendments passed at the previous meeting were adopted. These changes simply accommodate Electronic (Zoom) meetings. Initially Zoom Meetings were allowed under a Covid related Provincial Directive which has expired. These changes formalize the role of a zoom meeting in our bylaws.

Council authorized the issuance of a Development Permit for 440 Esplanade. An old house will be demolished and a new building constructed that will contain two strata residences and two tourist accommodation units. The building complies with zoning requirements. No variances are required. Plans show a very attractive building with good parking. The vote was four to one. I believe this building will be a positive addition to the village and to our tourist accommodation.

Council authorized the submitting of a grant application that must be forwarded by the end of January for storm sewer infrastructure on Harrison Hot Springs Road from the bridge by Settlers Pub to the bridge south of Ramona. This would ameliorate the drainage and occasional flooding of the properties on that section of the road and the road itself. Any work would be done in conjunction with the Province that owns the road. If successful the grant would pay almost three quarters of the cost with the balance coming from the Village’s Drainage Development Cost Charges reserves, which are monies paid into that fund by developers when they are allowed to develop lands. Estimated project cost was two million dollars. The recent November rains emphasized the need for this work.

And lastly a bylaw to establish a Revitalization Tax Exemption program was approved on a four to one vote. I am a strong supporter of this bylaw. Firstly it does not exempt any property from paying taxes. It merely gives a “holiday” from property taxes for the increased value of the property from the construction of a building, which “holiday” is eliminated over five years at 20 percent per year. The owner still pays taxes at the approximate rate as before construction. This DOES NOT apply to builders of new For Sale condo units. It is aimed at builders of rental apartments and affordable housing.

As most residents know, there are less rentals available in the village than there were five years ago. Seniors who would like to sell their houses and stay in the village have almost nowhere to go. Workers in our many restaurants and tourist accommodations have virtually nowhere to rent. Young people who can’t afford to buy are in a similar plight. This bylaw is aimed at encouraging construction of rental only buildings. And don’t worry, recent provincial legislation allows for covenants to ensure that a rental building stays a rental building.

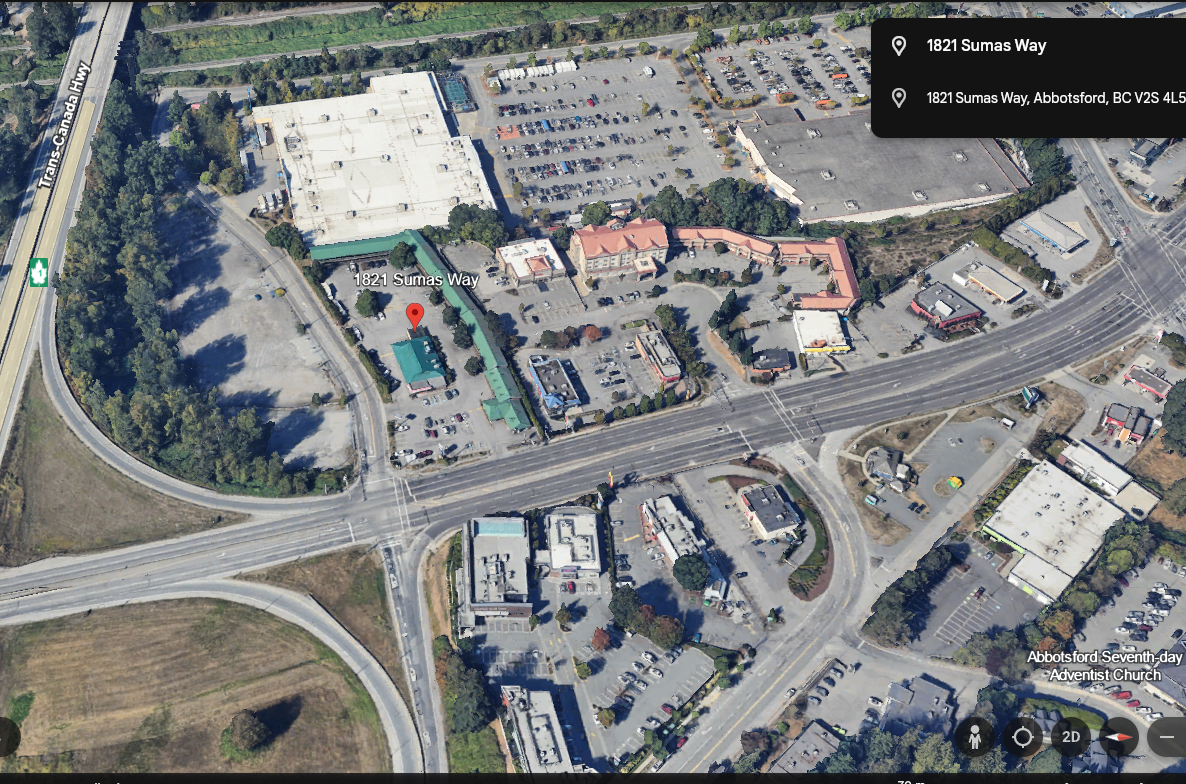

A similar tax exemption bylaw in historic downtown Abbotsford has contributed to the blossoming of that local area after a small group of us in the Abbotsford Downtown Business Association convinced the city to go forward with a similar program almost two decades ago. I hope that the bylaw that was passed last night will be similarly successful.