Vancouver (Kris Sims is the B.C. Director of the Canadian Taxpayers Federation) – It’s going to cost British Columbians more to fill their fridges, heat their homes and watch their favourite shows. The government is also hiking the income taxes. Add it all up and British Columbia’s 2020 budget is going to be expensive for taxpayers.

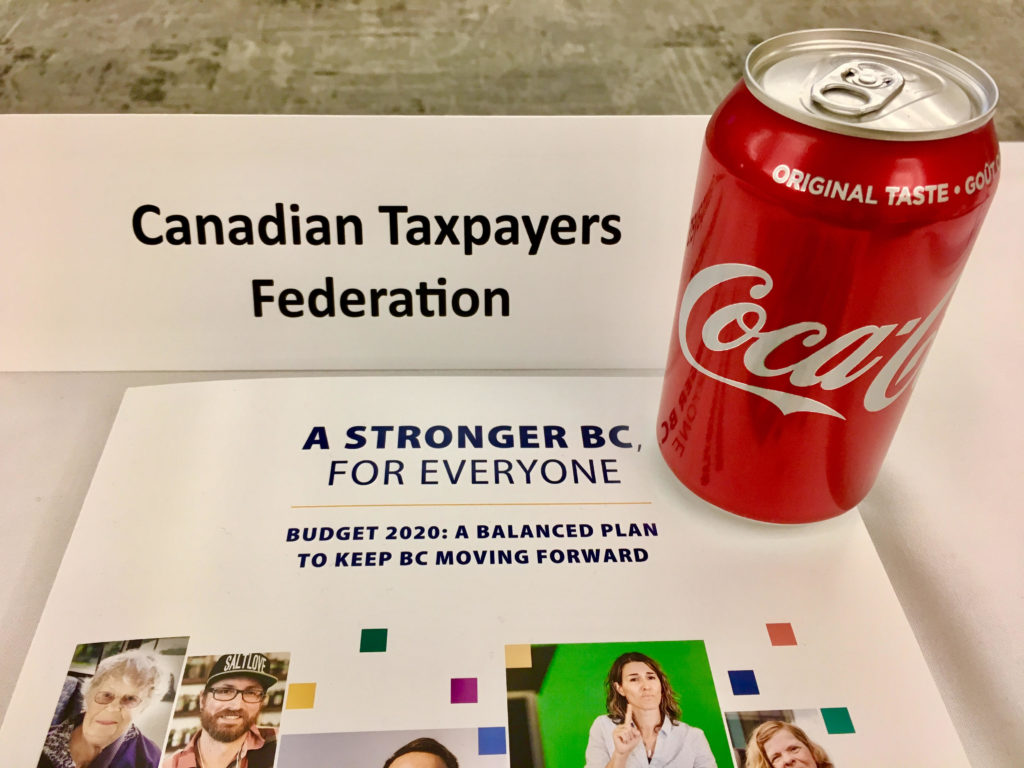

The sweetened drink tax hike will see the government take an extra $37 million from families in 2021. The government says the tax will make people healthier, but pop taxes don’t work. Mexico tried it and sales initially went down, but consumption bounced back up. Sweetened-drink taxes don’t tip the scales on obesity, but they do fatten government coffers.

What’s odd about this sweetened-drink tax is while the government says it’s to reduce sugar consumption and improve our health, the tax is also on beverages that don’t contain sugar. It applies to all beverages from a soda fountain, a soda gun at a bar or a vending machine. That means your diet cola with aspartame, your fancy pop with stevia or even your bottle of water from the mixed vending machine are getting hit with this sugar tax too.

The B.C. carbon tax on natural gas is going up even more than expected. We already knew that the tax was going from $40 per tonne to $45 per tonne on April 1, but now we are going to have to pay even more than that.

Since Ottawa is now imposing its tax on provinces, B.C. is harmonizing the provincial carbon tax with the federal carbon tax. Right now, the carbon tax on natural gas is $0.076 per cubic metre – a rate that already has the tax costing more than the price of fuel – and it’s now jumping up to $0.0882 per cubic metre. That means the B.C. government will be taking $17 million more from taxpayers than previously expected from the carbon tax on natural gas in 2020, and $18 million more than previously expected by 2021.

But wait, there are more taxes.

Now when British Columbians get home and it’s time to relax with some Netflix, they’ll be taxed on that, too. Perhaps we should call it Netflix and bill.

Buried deep in the budget on page 64 is a new tax on all streaming audio and visual content that originates outside of Canada. That means that people who pay for video and music services that originate outside Canada, such as Netflix and Spotify, will now have to pay more for their services. The government is planning on making $16 million on your relaxation by 2021.

There are still more taxes.

The NDP-Green government is hiking the income tax paid by people making more than $220,000 per year to 20.5% from 16.8%.

Governments are always eager to squeeze more out of those tax brackets, but they ignore unintended consequences. Here’s the reality: they’re punishing people such as surgeons, engineers and entrepreneurs who start businesses to create jobs for their neighbours. Do we want fewer of these people in B.C.? It’s probably not wise to risk driving them away because we wouldn’t lose only their expertise; we would lose the income taxes they would have been paying, and the rest of us would have to fill the void.

Families are being clobbered with new taxes and the government is still racking up more debt. The government is balancing the day-to-day operating portion of the budget, but when you consider all of the government’s spending, including capital costs, the debt will increase by $17.5 billion in just three years. And taxpayers will have to pay $2.7 billion every year just on the debt interest charges.

This provincial budget imposes plenty of tax hikes on our everyday lives while pulling us even deeper into debt. B.C. politicians campaigned on making life more affordable for British Columbians, but, instead, they are making it more expensive to live here.